Spousal plan calculator

How to use the Spousal Plan Calculator

If you answered YES to ALL of the questions in Benefits 24/7 or on your enrollment form, answer the questions in the PEBB Spousal Plan Calculator (interactive tool) or (pdf) to determine if you must pay the surcharge.

Use the Summary of Benefits and Coverage from your spouse's or state-registered domestic partner's employer-sponsored medical plans to answer the Spousal Plan Calculator questions. The plans must:

- Serve your spouse's or state-registered domestic partner's county of residence, and

- Cost less than $126.36 (2025) for the employee's share of the monthly premium.

Complete the calculator for each medical plan that meets the criteria above, one plan at a time. Then click Calculate. If you are entering more than one plan, and at lease one results in "You will have to pay the surcharge," then you will have to pay the surcharge.

Need help?

Find how to answer the questions in the Spousal Plan Calculator.

- Question 1: Is this an HDHP or a CDHP?

-

Where to look?

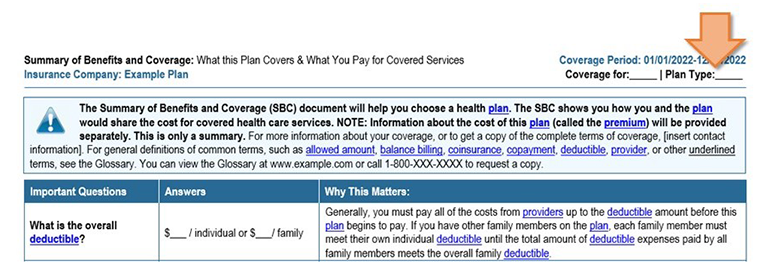

You will see Plan Type in the top right corner of the Summary of Benefits and Coverage.

How to answer?

If the Plan Type says:

Answer like this:

- HDHP

- CDHP

- HSA

- HRA

- any combination of the above (example: HDHP/HSA)

It is a high-deductible health plan.

Select YES for Question 1A.

Fill out B (see below for help).

Continue to Question 2.

- HMO

- PPO

- POS

It is not a high-deductible health plan.

Select NO for Question 1A.

Skip B.

Continue to Question 2.

If yes, how much does the employer contribute each year into an individual's health savings account (HSA) or health reimbursement account (HRA)?

This information is available from your spouse's or state-registered domestic partner's employer. Ask them to ask their employer's payroll or benefits office to find the answer.

- Question 2: How much are the plan's deductibles?

-

Where to look?

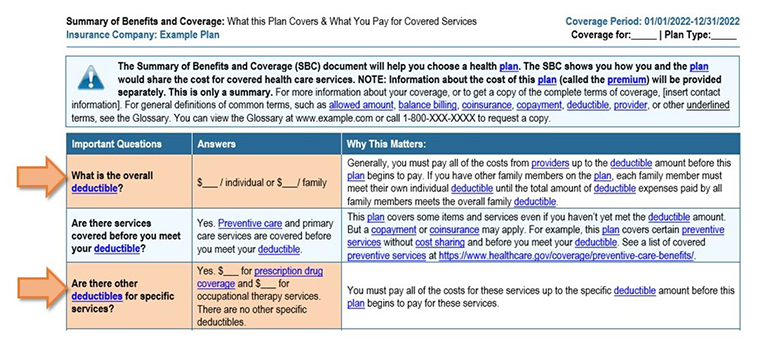

You will see:

- "What is the overall deductible?" and

- "Are there other deductibles for specific services?"

under "Important Questions" on the Summary of Benefits and Coverage.

Only look at the amounts for a single person (or individual) using a preferred (or in-network) provider.

How to answer?

If you see:

Answer like this: Only one overall deductible (no separate deductible for prescription drugs) Fill out A.

Skip B1 and B2.

Go to Question 3.

An overall deductible and a separate deductible for prescription drug coverage Skip A.

Fill out B1 with the overall (or medical) deductible.

Fill out B2 with the prescription drug deductible.

Go to Question 3.

- Question 3: How much are the plan's out-of-pocket limits?

-

Where to look?

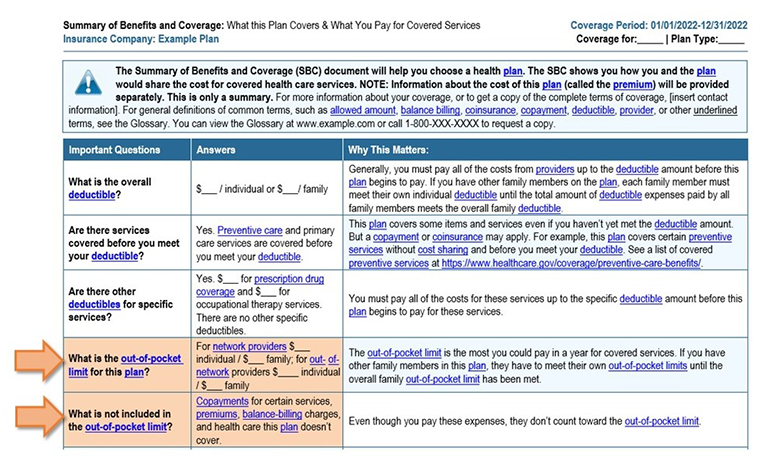

You will see:

- "Is there an out-of-pocket limit on my expenses?" and

- "What is not included in the out-of-pocket limit?"

under "Important Questions" on the Summary of Benefits and Coverage.

Only look at amounts for a single person (or individual) using a preferred (or in-network) provider.

How to answer?

If you see:

Answer like this: Only one out-of-pocket limit (no separate out-of-pocket limit for prescription drugs) Fill out A.

Skip B1 and B2.

Go to Question 4.

An out-of-pocket limit and a separate out-of-pocket limit for prescription drug coverage

Skip A.

Fill out B1 with the medical out-of-pocket limit.

Fill out B2 with the prescription drug out-of-pocket limit.

Go to Question 4.

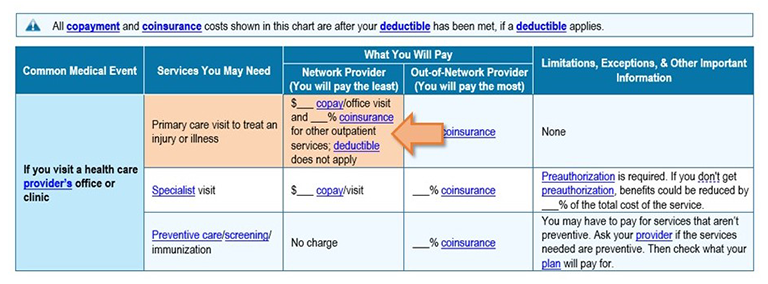

- Question 4: What is the most common coinsurance among these services?

-

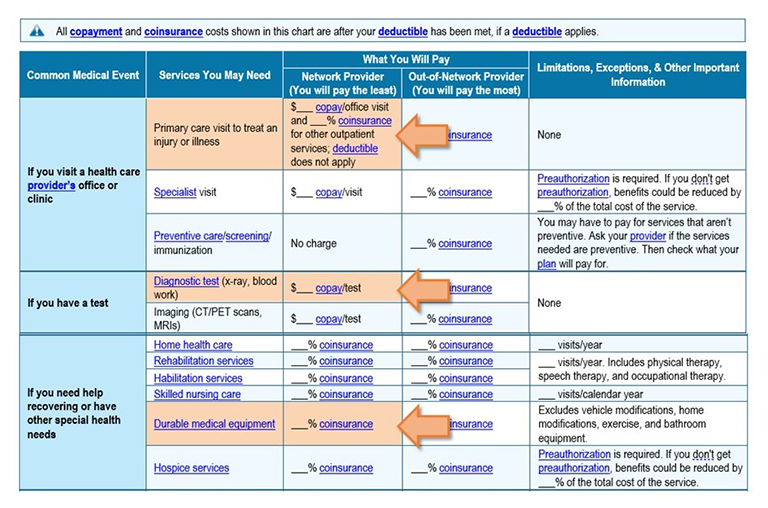

1. Primary care visit to treat an injury or illness,

2. Diagnostic test, and

3. Durable medical equipment?

Where to look?

You will find all three services listed under "Common Medical Events" and "Services you May Need" on the Summary of Benefits and Coverage.

Only look at amounts for a single person (or individual) using a preferred (or in-network) provider.

How to answer?

If you see:

Answer like this: The same coinsurance amount for at least two of these services

Examples:

- One service has a copay, and the other two have the same coinsurance amount

- All three services have the same coinsurance amount

Fill out Question 4 with the coinsurance amount you see most often.

Different coinsurance amounts, or copays and coinsurance

Examples:

- One service has a copay, and the other two have different coinsurance amounts

- Two services have copays, and one has coinsurance

- All three services each have different coinsurance amounts, or copays ($) with coinsurance

Fill out Question 4 with the highest coinsurance amount you see.

Copays for all three services Skip Question 4. Go to Question 5.

- Question 5: How much for a primary care visit to treat an injury or illness?

-

Where to look?

You will find "Primary care visit to treat an injury or illness" listed on the Summary of Benefits and Coverage under "Common Medical Events" and "Services You May Need."

Only look at amounts for a single person (or individual) using a preferred (or in-network) provider.

How to answer?

If you see:

Answer like this: Only a copay

Fill out Question 5 with the copay amount

Go to Question 6

Only a coinsurance

Skip Question 5

Go to Question 6

A copay and a coinsurance Skip Question 5 Go to Question 6

- Question 6: How much for emergency room services?

-

Where to look?

You will find "Emergency room services" listed on the Summary of Benefits and Coverage under "Common Medical Events" and "Services You May Need."

Only look at the amount for a single person (or individual) using a preferred (or in-network) provider.

How to answer?

If you see:

Answer like this: Only a copay

Only a coinsurance

Fill out Question 6 with the copay amount

Go to Question 7

Skip Question 6

Go to Question 7

A copay and a coinsurance Skip Question 6 Go to Question 7

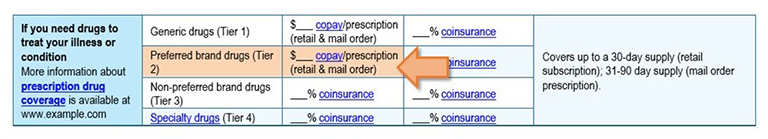

- Question 7: How much for preferred brand drugs (or formulary drugs)?

-

Where to look?

You will find "Preferred brand drugs" listed on the Summary of Benefits and Coverage under "Common Medical Events" and "Services You May Need."

Only look at the amount for a single person (or individual) using a preferred (or in-network) provider.

How to answer?

If you see:

Answer like this: A coinsurance (%) Fill out A.

Skip B.

A copay ($) Skip A.

Fill out B.

Complete your attestation

- If adding a spouse or state-registered domestic partner to your PEBB medical plan, you must respond to the spousal coverage surcharge using Benefits 24/7 or the appropriate enrollment/change form.

- If you are reporting a change, use Benefits 24/7 or submit the PEBB Premium Surcharge Attestation Change form as directed on the form.